Client

Menora Mivtachim

Industry

Insurance

Skills

UX Design | UI Design | Visual Identity | Digital Strategy

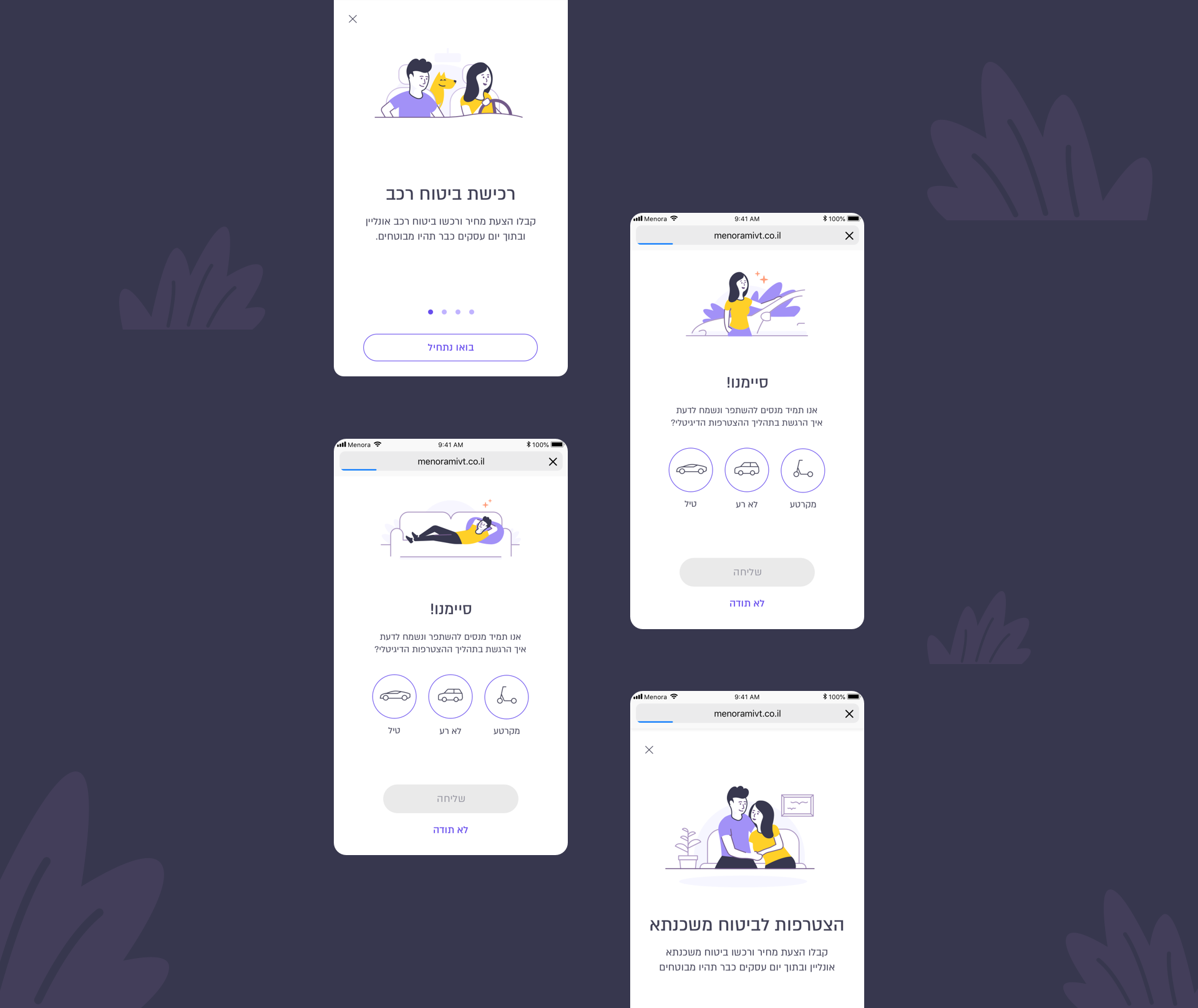

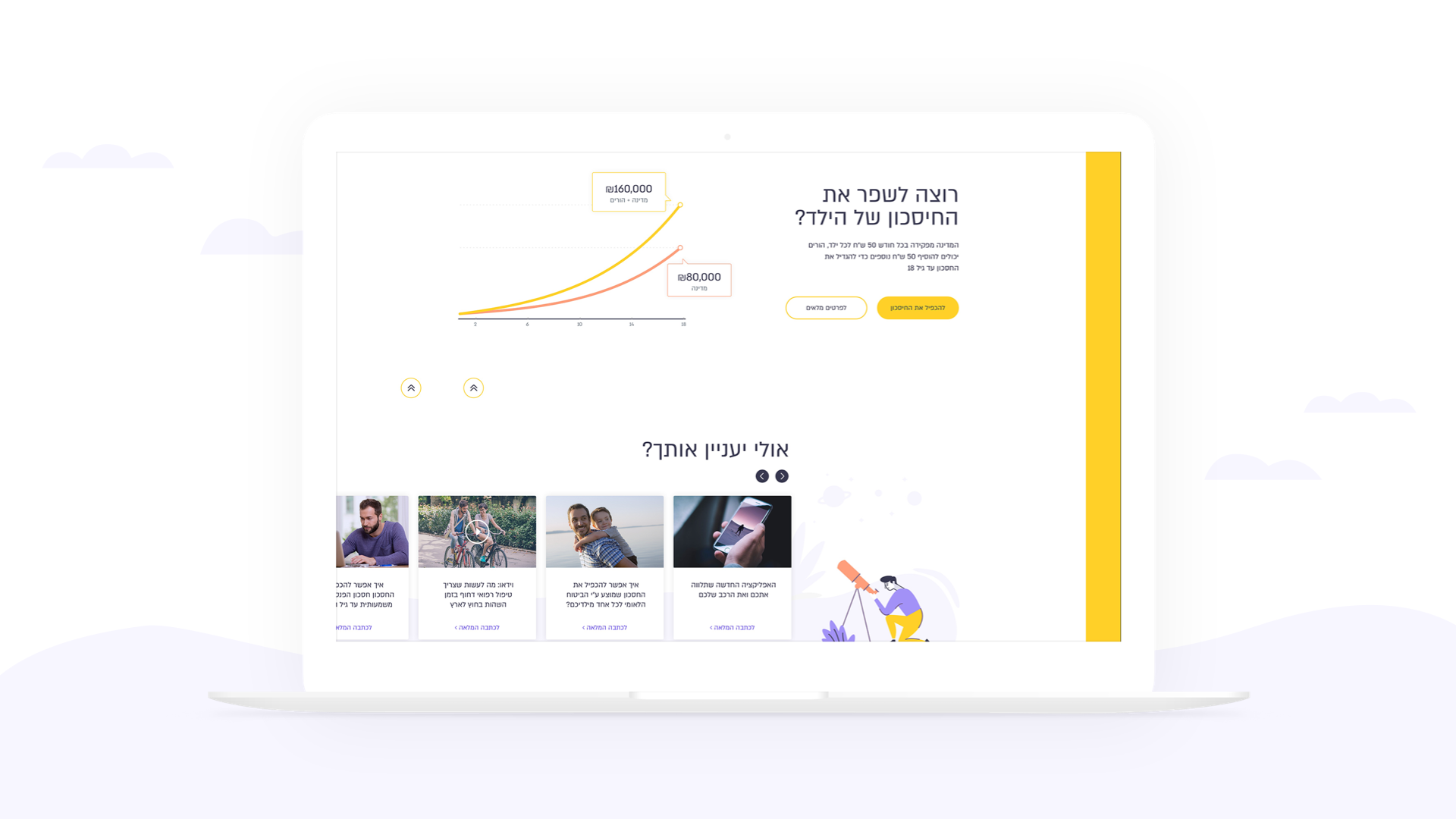

An Experience that Sells the Product

If you ever went through the process of purchasing insurance, you know how unpleasant it can be. The terminology, bureaucracy and multiple procedures make us feel as if we are lost in the middle of the ocean. How ironic is it, that something you buy to feel safe makes you feel so unsafe when you buy it? That is how a new customer-centric digital insurance was born, providing an intuitive experience that sells what the product sells: simple, immediate, painless security.

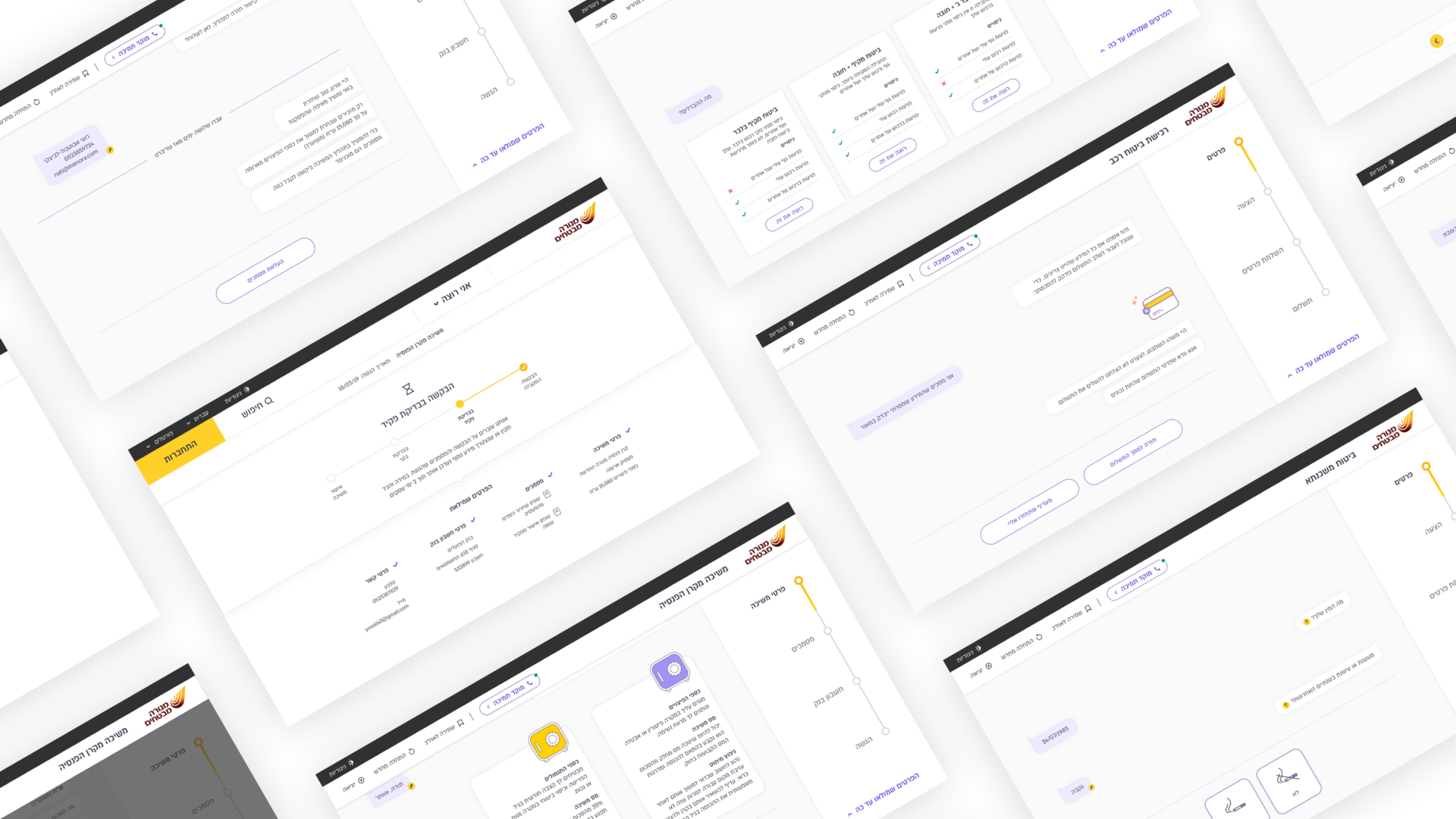

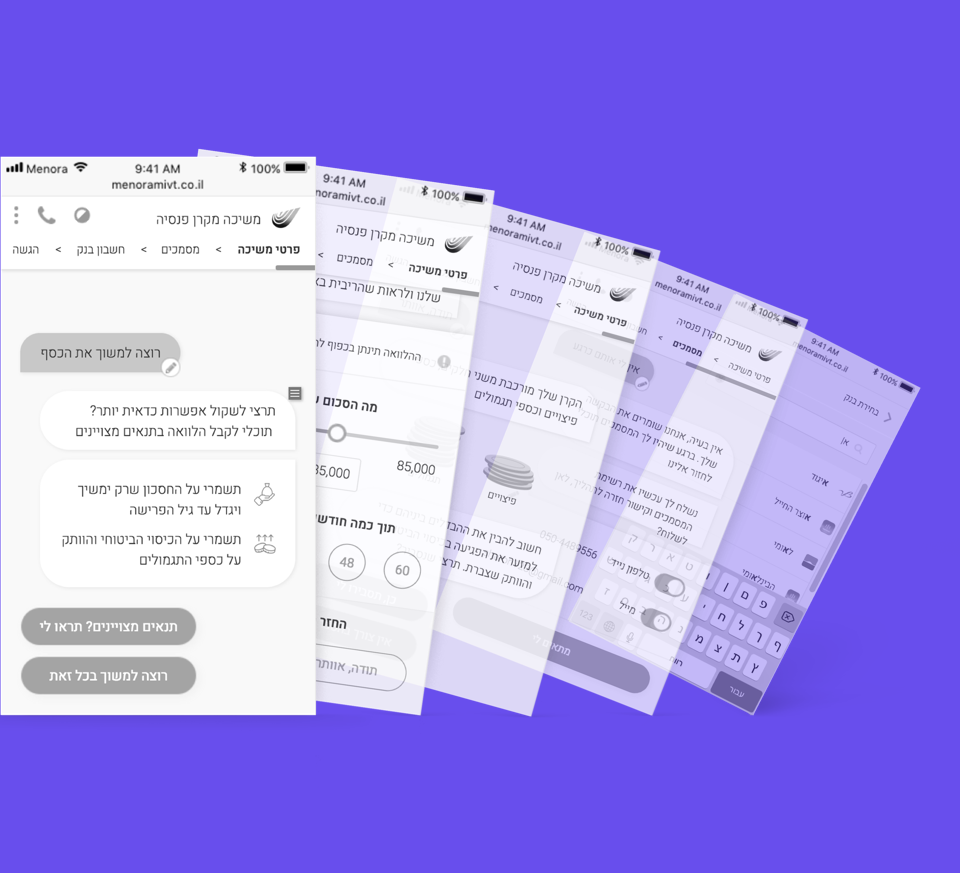

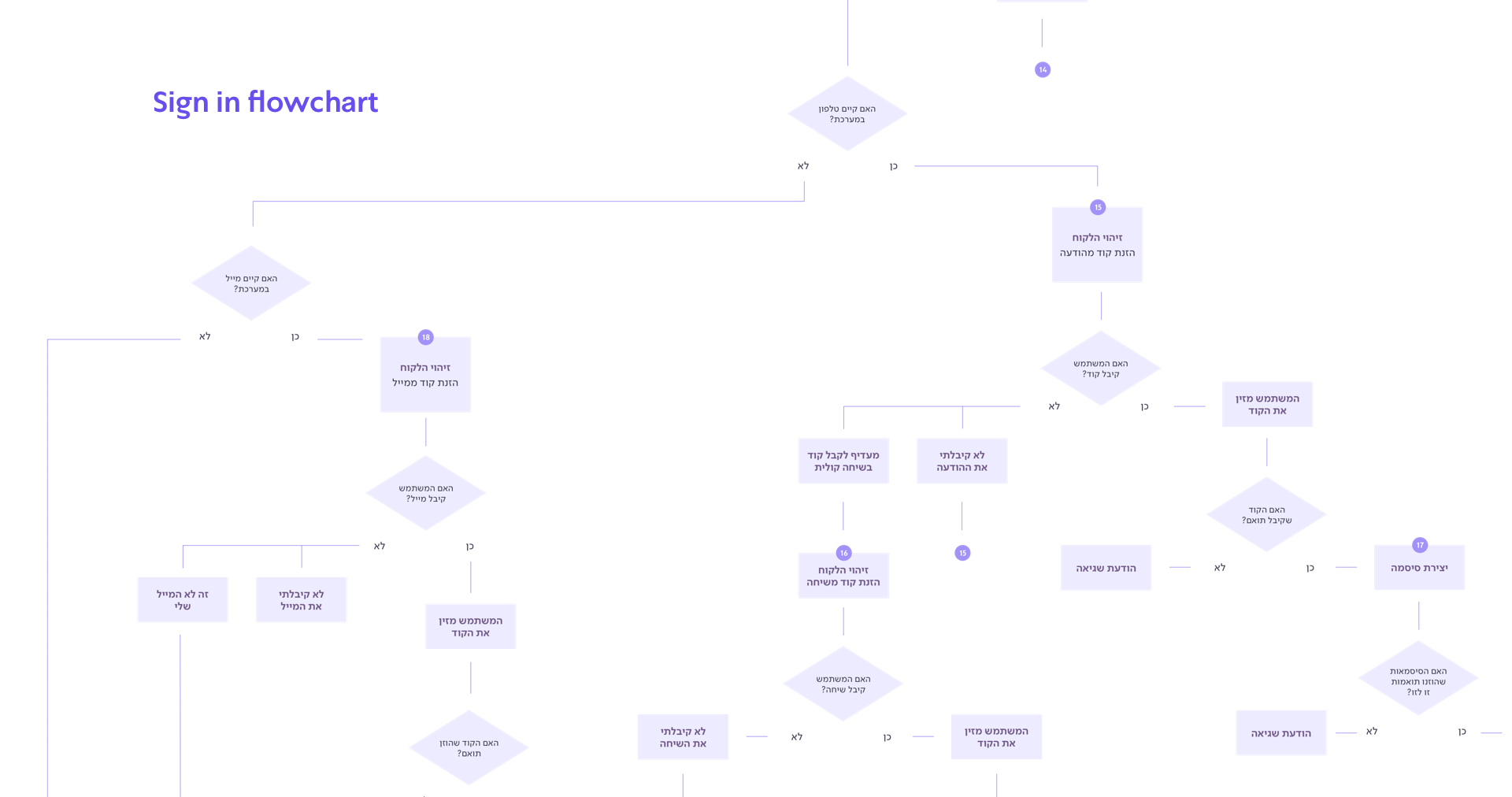

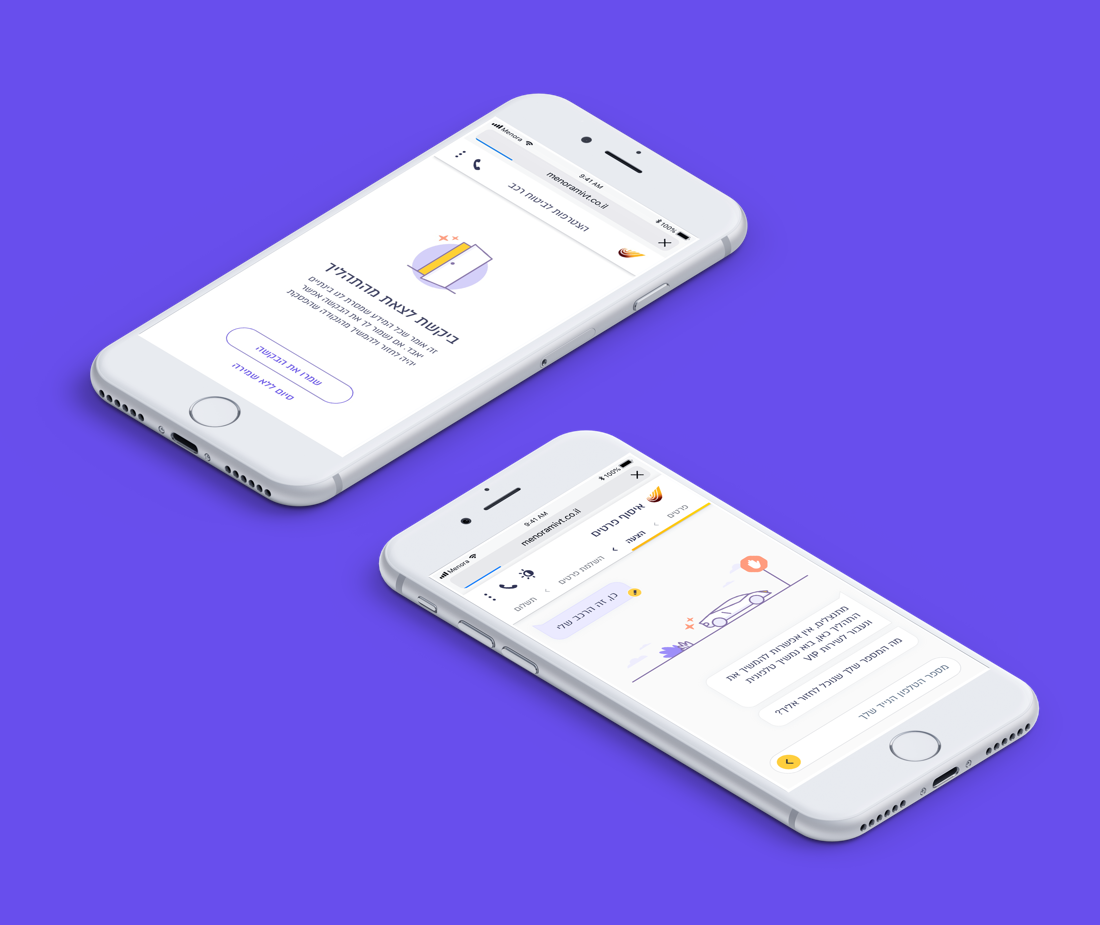

A Digital Service Provider: The Chatbot

Think about the most helpful service provider you ever encountered, give it the ability to serve thousands of people at the same time, and now you have created a chatbot. The magic of it relies on having an answer to every need. We applied customer-centric methods to analyze endless scenarios, then converted them into charts that where translated to a modern, slick interface.

Empowering Customers

Menora’s new digital insurance is resourceful, smart and transparent. The clear explanations and immediate processes allow customers to control their assets. Action can be made on the spot; everything is responsive and automated. The process builds client confidence and makes him a fully independent decision maker.

Simple Processes, Great Value for All

Digital insurance has great value for the customers, and it’s also a great time saver for the service provider. The digital service cuts long conversations, frustration, client transferral from one department to another, allowing human service provider to attend the more complex and skill-demanding cases. The rest are well taken can of.